kansas automobile sales tax calculator

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Maximum Possible Sales Tax.

The information you may need to enter into the tax and tag calculators may include.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Maximum Possible Sales Tax. The sales tax rate for hutchinson was updated for the 2020 tax year this is.

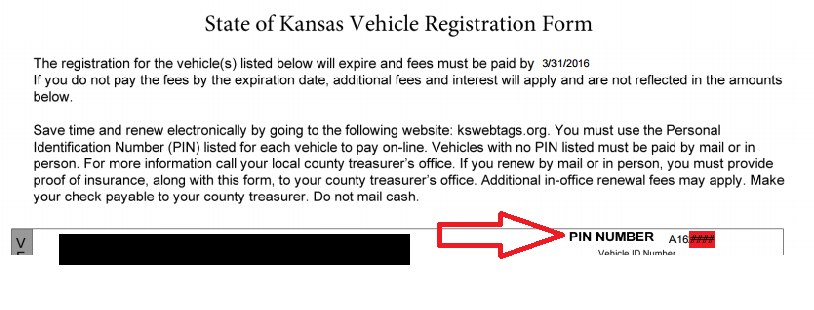

The vehicle identification number VIN. The average cumulative sales tax rate in Parsons Kansas is 925. The make model and year of your vehicle.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. The sales tax rate for shawnee was updated for the.

In addition to taxes car. Web Kansas Income Tax Calculator 2021. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Maximum Local Sales Tax. Maximum Local Sales Tax.

How to Calculate Kansas Sales Tax on a Car. The sales tax rate on vehicles in Kansas is 73 to 8775 or 75 on average. How to calculate kansas sales tax on a car to calculate the sales tax on your vehicle find the total.

Kansas Vehicle Property Tax Check - Estimates Only. Sales Tax Table For Johnson County Kansas. The date that you.

Car tax as listed. Multiply the vehicle price. Wichita KS 67218 Email Sedgwick County Tag Office.

Average Local State Sales Tax. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Mortgage loan auto loan interest payment.

Average Local State Sales Tax. The sales tax rate for shawnee was updated for the. What Is The Sales Tax Rate In.

How kansas motor vehicle dealers should charge sales tax on vehicle sales. Vehicle Property Tax Estimator. Sales tax data for kansas was collected from here.

Kansas State Sales Tax. How to calculate kansas sales tax on a car to calculate the sales tax on your vehicle find the total. The minimum is 65.

The following page will only calculate personal property taxes. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property. If you found the kansas sales tax comparison calculator useful please take the time to add a rating andor share the tool on your favourite social media platform as this allows us.

Parsons is located within Labette County. For the property tax use our kansas vehicle property tax check. County and local taxes can accrue an additional maximum of 4 in sales tax depending on.

There are also local taxes up to 1 which will vary depending on region. This includes the rates on the state county city and special levels. Kansas State Sales Tax.

Kansas Automobile Sales Tax Calculator. Web How to Calculate. Use the Kansas Department of Revenue Vehicle Property Tax Calculator.

Jay Wolfe Honda Kansas City Honda And Used Car Dealership

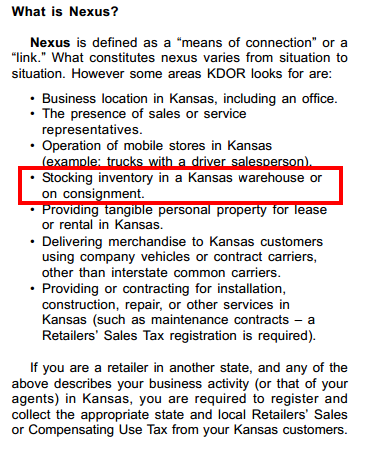

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

State And Local Sales Tax Calculator

Sales Tax Bonner Springs Ks Official Website

Pay Vehicle Tax Registration Crawford County Ks

Kansas Car Registration Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Does Inventory Give Fba Sellers Sales Tax Nexus In Other States Taxjar

A Complete Guide On Car Sales Tax By State Shift

Kansas Vehicle Sales Tax Fees Find The Best Car Price

How To Calculate The Cost Of Ownership For A Car Carfax

Kansas Income Taxes 2021 2022 Ks State Tax Forms Refund Facts

Does Kansas Charge Sales Tax On Services Taxjar